Divested?

Not completely.

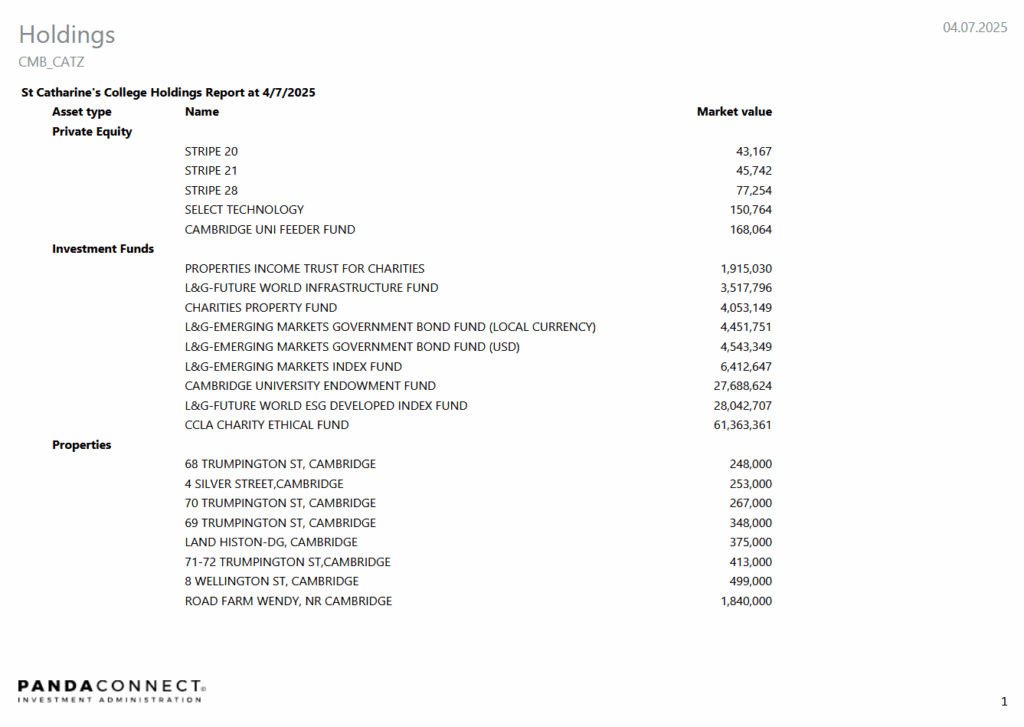

Catz has an ethical investment policy which largely excludes direct and indirect investments in arms. However, Catz holds investments in the University’s Endowment Fund which has not divested, and its other funds require further research.

FOI Request

Successful.

Provided a full list of holdings:

Investment Policy

St Catharine’s ethical investment policy:

“It is the College’s policy to take account of ethical and other issues of social responsibility and the values of the Collegiate University when taking investment decisions. This includes consideration of the theory of universal ownership when working to address climate change as one of the biggest challenges humanity has ever faced and targeting net zero for St Catharine’s College by 2040.”

“The College does not and will not hold any direct investments in fossil fuel, arms, tobacco, child labour or gambling industries.”

“Currently the College only holds indirect investments primarily through funds managed by CCLA Investment Management and Legal & General Investment Management (LGIM).”

“CCLA’s COIF Charities Ethical Investment Fund is managed in accordance with an ethical investment policy…: no investment in unconventional weapons, electrical utilities that are not aligned with the Paris Agreement, and any companies primarily focussed on oil sands/coal extraction, fossil fuel extraction, armaments, tobacco, alcohol, adult entertainment, and gambling.”

“The majority of the equity holding managed by LGIM is in the Future World ESG Developed Index Fund which excludes unconventional weapons, armaments, coal, tobacco and perennial offenders of the UN Global Compact… The fund seeks to reduce carbon emissions and carbon reserves intensity and at October 2020 it had 66% lower carbon reserves intensity and 45% lower carbon emissions intensity compared to a fund tracking the unadjusted benchmark.”