Divested?

No.

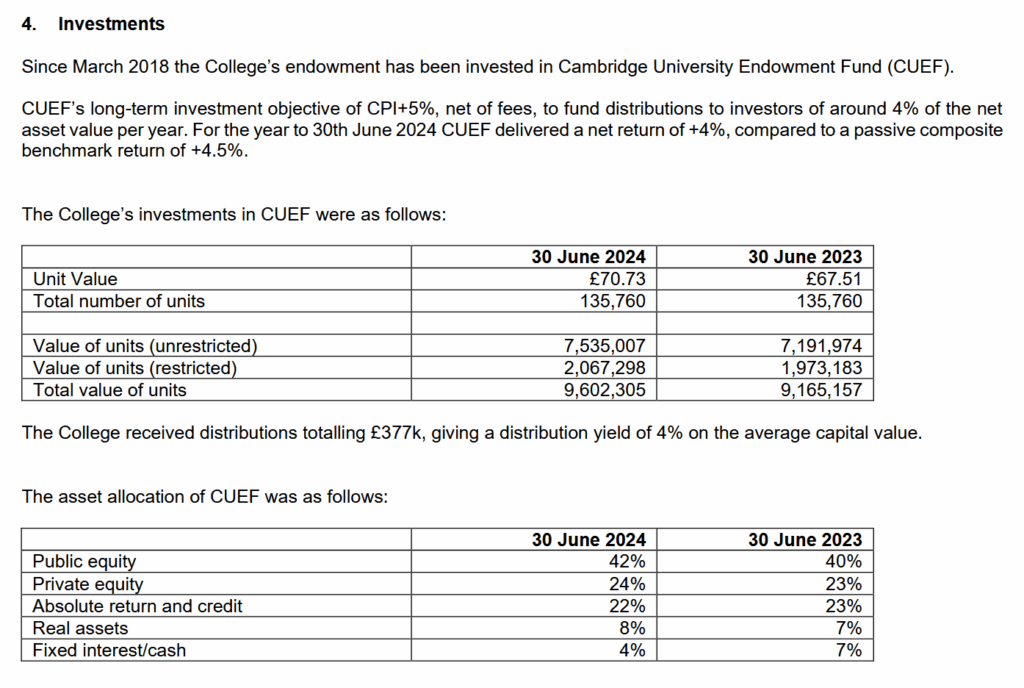

St Edmund’s holds all of its investments within the Cambridge University Endowment Fund, which has not divested.

FOI Request

Successful, but uninformative as the college could or would not provide further information on the CUEF breakdown of investments. Referred to the College Statutory Accounts for further information on college investments.

College Statutory Accounts, year ending 30 June 2024: