Divested?

No.

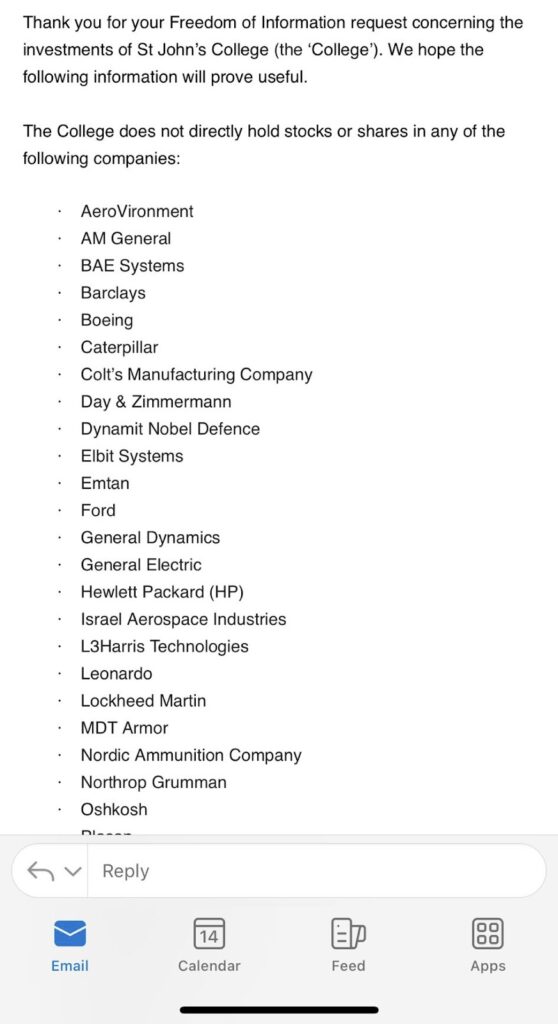

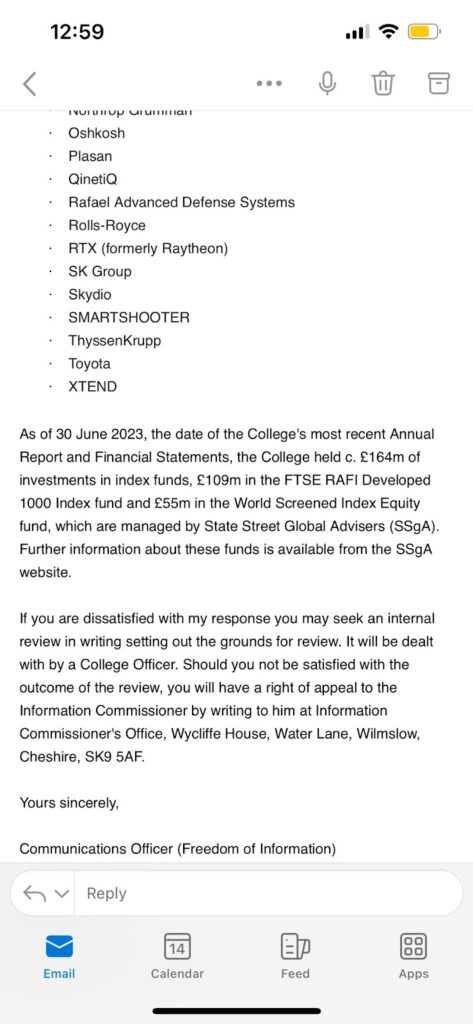

FOI Request

Successful.

FOI Report

£109m in FTSE RAFI Developed 1000 Index Fund: Content Breakdown

£55m in World Screened Index Equity fund: Content Breakdown

Both managed by State Street Global Advisers (SSgA) – See website for more information on these funds

Calculations

FTSE RAFI Developed 1000 Index Fund

- At least 0.66% in ‘defense’ (719,000)

- 1.34% in JP Morgan (1,460,600)

- Total: at least 2% = at least £2,179,600

World Screened Index Equity fund

- HP: 0.06%

- JP Morgan 0.95%

- Siemens: 0.22

- Israeli companies: 0.2%. Note Elbit makes up 0.01%

- BAE Systems= 0.07%

- Rolls Royce= 0.03%

- Geneal Electric= 0.21%

- HP=0.05

- Palantir 0.04%

- Barclays 0.05%

- Total: 1.88% = £1,034,000

TOTAL Johns complicity = at least £3,213,000 invested in Israel and arms companies facilitating genocide

Contacts

Senior bursar: Chris Ewbank; c.f.ewbank@joh.cam.ac.uk

Senior tutor: Richard Partington; r.partington@joh.cam.ac.uk

Master: Heather Hancock; master@joh.cam.ac.uk